(Guest Post by Jason Bedrick)

By now, everyone in the ed policy world is aware of the damning report by Johns Hopkins University Institute for Education Policy on Providence’s district schools. Rhode Island’s Commissioner of Education, Angélica Infante-Green, called it “heart-wrenching” and admitted that she would not send her children there. When asked by Erika Sanzi what Providence families are supposed to do, Infante-Green responded, “We are going to fight and work hard to change decades of neglect.”

Decades. Of. Neglect.

Matt Ladner summarizes the report’s highlowlights:

- The great majority of students are not learning on, or even near, grade level.

- With rare exception, teachers are demoralized and feel unsupported.

- Most parents feel shut out of their children’s education.

- Principals find it very difficult to demonstrate leadership.

- Many school buildings are deteriorating across the city, and some are even dangerous to students’ and teachers’ wellbeing.

I guess that’s what $18,000 per pupil gets you in Providence.

Some people roll their eyes when conservatives and libertarians rant about bureaucracy and teachers’ union contracts, but these things really can get in the way of delivering a high-quality education. The report finds that the collective bargaining agreement makes it “next to impossible to remove bad teachers from schools or find funding for more than the one day of contractual professional development per year.” But that’s just the tip of the iceberg.

Take procurement, for example. As Stephen Sawchuk noted at EdWeek, “Nothing is less sexy than procurement, and yet nothing matters more in terms of getting basic supplies, repairs, and textbooks into classrooms.” Yet the procurement process in Providence is practically strangled with red tape and bureaucratic inefficiency:

The “unwieldy” process is compounded by the fact that any request that is more than $5,000, must be voted upon by the City Council and the School Board. Every element of the process came under fire from district leaders and partners:

- The RFP [request for proposal] process “is onerous; even the form is too long.”

- Because of this, “it is hard to attract high-quality vendors.”

- “There is no transparency around RFPs.”

- “The RFPs don’t even include scoring rubrics.”

- Small vendors are handicapped, because they don’t have the staff to attend multiple committee and full board meetings.

- One partner noted, “It took us two years to get a contract under $20,000 approved.”

- Another noted the outdated requirements, such as presenting proposals in triplicate binders with tabs in a specified order.

- “[Providence Public School District] can enter into only short-term, reactive partnerships. There isn’t the long-term arc of partnership that a three-year contract would allow.”

- The volume of paperwork that results is “stunning.”

- “There are hundreds of contracts, hundreds of purchase orders. Even philanthropic dollars have to go through the process.”

- “The whole process is cumbersome.”

- “There are constant meetings.”[emphasis added]

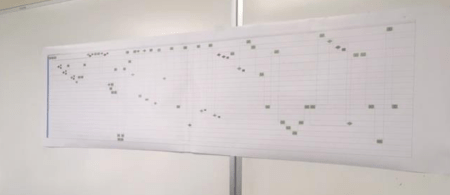

The report even included an image of “a chart of all of the players and steps that any contract must go through before approval” that one of the district leaders had pinned up:

It’s amazing that anything gets done at all.

One of the central problems is that there are so many cooks in the kitchen. As Sawchuk observes:

Perhaps the headline finding of this report is that there are at least five different, competing entities that are asserting power over the school system, making it difficult to proceed on any set of changes or reforms. (They consist of the mayor, the Providence city council, the school board, the superintendent, and the state department of education). It’s hard to overstate how bizarre this is, but there’s an entire appendix detailing which of these entities view the others as obstacles or competitors.

Not only do the entities get in each others’ way and slow down the process of getting stuff done, but there’s also no sense of accountability. Each entity has enough authority to obstruct the others, but none has the requisite authority to actually run the schools well. When something goes wrong, it’s not clear where the proverbial buck is supposed to stop. Each entity can plausibly point fingers at all the other entities “in charge.”

Chaos in governance is reflected in chaos in the classroom. The report details a complete breakdown of order that is severely undermining learning:

Discipline. Many teachers do not feel safe in school, and most partners and district staff concur. There is a general feeling that actions do not have consequences, and that teachers are at physical and emotional risk. One interviewee feels like “the tired, drained teachers of Providence are dragging kids across the finish line.” A few representative comments:

- “My best teacher’s desk was urinated on, and nothing happened.”

- “One of our teachers was choked by a student in front of the whole class. Everybody was traumatized, but nothing happened.”

- “When we refer a student, we get zero response. Kindergartners punch each other in the face –with no consequences.”

- “Principals are not allowed to suspend.” [emphasis added]

How could this happen? (Paging Max Eden!) The authors of the report point to misguided policies intended to make the schools look better on paper but actually make them far worse in reality:

Some of these issues likely result from pressure to reduce suspensions. Teachers and district leaders feel that children with behavioral problems are allowed to continue, passed from one classroom and school to another. Several noted that the number of social workers in schools is too modest.

- Said one district leader, “the data masks what’s happening. We can SAY we’re reducing suspensions, but we’re just churning middle schoolers.”

- Several teachers note that the plan to implement restorative practices foundered because of lack of PD [professional development], but “we’re still supposed to use them. Restorative practices cannot be done unless everybody in the building is trained.”

The Student Affairs Office (SAO) came up frequently in this issue. Teachers are seldom informed when a child in their classroom has been violent, but “if an SAO student skips my class, I’m in trouble.”

- Students are passed from one school to another; “some schools have become dumping grounds for kids.”

- One district leader noted that principals often “bargain” about problem children, doing whatever they can to avoid taking a troublemaker.

- One district leader said simply, “the students run the buildings.”

It must be noted that support staff, including bus drivers, share these concerns. One interviewee noted that “many bus drivers are getting injured,” but when they bring safety concerns to the district, “it falls on deaf ears.” [emphasis added]

Again: it’s amazing that any learning gets done at all.

Throw good money and good people at a bad process and the process will win every time. Providence’s district school system appears broken beyond repair. The only way to fix it is to fundamentally restructure it, but the only way to do that is to provide families with alternatives. As people flee the system, those running the system will have a huge incentive to make the necessary changes.

In the meantime, kids need alternatives to the nightmare in Providence.

Posted by Jason Bedrick

Posted by Jason Bedrick