(Guest Post by Jason Bedrick)

The constitutionality of tax-credit scholarships is in the news again, as Montana’s state supreme court will soon consider the issue. What makes Montana’s case unique is that the roles of the petitioners and respondents is reversed. Usually it’s school choice opponents who sue a state over its choice program. In Montana, the Department of Revenue decided — against the wishes of the legislature — to block tax-credit scholarship recipients from using them at religious schools based on its own squirrelly interpretation of the state constitution. That drew the ire of choice proponents, including the heroes at the Institute for Justice, who sued.

A district court judge ruled in favor of the Institute for Justice, but the state has appealed the decision to the Montana Supreme Court.

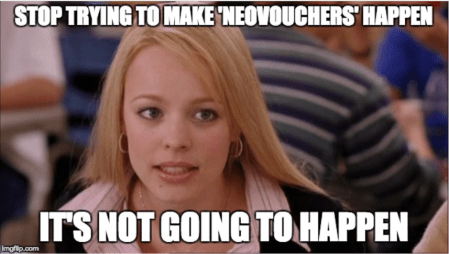

Based on the track record, tax-credit scholarships are very likely to win. But Kevin Welner, a long-time critic of tax-credit scholarships (he calls them “neovouchers,” but no one serious has followed his lead), disagrees:

“If you’re asking if this is an area of unsettled law, the answer is yes,” Welner said. “Generally, the differences that you see are reflective of the blue-red differences we have in this country.”

Is that so? Let’s see what the scorecard shows. First, the victories:

Tax-Credit Scholarship Legal Victories

- Supreme Court of the United States

- Alabama

- Arizona

- Florida

- Georgia

- Illinois

- New Hampshire

It should be noted that the unanimous decision in Georgia was written by a justice appointed by a Democrat. In Florida and Illinois (not a red state, last I checked), the state supreme courts refused to hear appeals of lower-court victories. Also, before anyone objects “some of these were decided on standing, not the merits!” — there’s very little difference. First, all the decisions but New Hampshire’s explicitly state that tax credits do not constitute public expenditures in their decisions ruling against the plaintiffs’ standing, which is essentially ruling on the merits. Even New Hampshire’s state supreme court (which had a liberal majority) unanimously ruled against standing because the plaintiffs could not demonstrate any harm. Second, there’s functionally no difference between “constitutional” and “may or may not be constitutional on the merits but no one has standing to sue so the program may legally continue.”

Anyway, let’s now look at the losing side of the ledger to see how truly “unsettled” this area of law is:

Tax-Credit Scholarship Legal Defeats

- None

This looks less like a “red state vs. blue state” divide than a “real state vs. imaginary state” divide.

My question for Welner is: how many states have to follow the U.S. Supreme Court’s lead before he believes the law is “settled”?

Also, a closing word of advice:

I hate that tax-credit scholarships are more likely to be upheld, since they’re an inferior design in every other respect, and can’t realistically be taken to adequate scale. And of course also because the case against the constitutionality of other forms of school choice is so bogus that Roy Moore laughs at it. But the irrationality of judicial idealogues is what it is.

What is everyones take on the odds that a lawsuit against the “frankenstein” SC tax credit scholarship program will be the first LEGAL DEFEAT? A single SFO with a government appointed board and complete administration of the single SFO is done by a government agency (the Department of Revenue). With these government attachments would it be outside the protections of Arizona Christian School Tuition Organization v. Winn 563 US 125 (2011)? Seems so to me. Pro-choice groups want to sue this program too.

The US Supreme Court has affirmed vouchers, so federal precedent isn’t limited to tax-credit scholarships; if there’s any trouble it seems overwhelmingly likely it’ll only be at the state level. I don’t know what the judicial climate is like in SC.

This is not a concern. Even vouchers would be constitutional in South Carolina.

Click to access 50-state-SC-report-2016-web.pdf

So we all agree #1 it is a voucher program given it has a government appointed board and administered by the SC Department of Revenue, #2 the program has none of the “lack of standing” protections afforded to tax credit scholarships under Winn, and #3 as a voucher program it can be sued by any taxpayer (since they have standing) and could possibly be shut down with a court injunction similar to what happened to the ESA program in Nevada?

No, Jeff, wrong on all three counts and please do not try putting words in my mouth.

1) No, it’s not a voucher program. I said *even* a voucher program would be constitutional in SC. But SC has a tax-credit scholarship. It is publicly administered, which is unusual as tax-credit scholarships go — and you know WHY that’s the case, Jeff; it’s primarily because of YOUR shenanigans — but it is entirely privately funded, just like other tax credits.

2) Again, no. The program relies on private donations, just like any other state. It should have the same standing protections.

3) Nope. And even if a taxpayer *were* to have standing (which is unlikely), it would be highly unlikely that the court would halt the program. The injunctions usually come down BEFORE a program goes into effect. Lawsuits in Florida, Georgia, etc. against tax-credit scholarship programs didn’t stop the program during the case.