A major industry has gotten in line to receive a bailout. It directly employs more than 6 million people. That’s a lot of people considering that there are a total of 300 million men, women, and children in the US of whom 137 million are currently employed (excluding farmers). So the workers in this industry constitute about 4% of all workers in the US.

Those 6 million workers directly serve almost 50 million customers. While recent figures are not available, the industry had revenue of about $536 billion as of 2006 when total US GDP was $13.13 trillion. So this industry constitutes about 4% of total US GDP.

Despite its size and importance, this industry has a notorious track record of performance. It fails to complete more than a quarter of the products it starts. Even among those it does finish, almost 40% fail to meet basic standards for quality. Quality has not improved a smidge in over three decades despite more than doubling the average cost of production. And foreign competitors are cleaning our clocks. In a comparison of 21 industrialized countries, US quality exceeded only that of South Africa and Cyprus.

And this industry has huge and understated pension liabilities that, failing a miraculous improvement in the returns on investments, will inevitably have to be paid by taxpayers. These “legacy” costs are consuming an increasing share of resources and distorting labor markets, hindering an industry turnaround. But the unionized workforce continues to press for increased pay and benefits while opposing restructurings that might address quality-control problems.

Despite an unwillingness to correct its structural weaknesses, either controlling costs or improving quality, captains of this industry are appealing to politicians for a bailout. As one recently said, “‘The most commonly heard solution out of Washington these days is a bailout where the federal government intervenes to safeguard key industries and in the process, the quality of American life. If that’s the rationale, than I cannot think of a more strategic investment than safeguarding the quality of [our industry].”

Are we talking about the US auto industry? It sounds like we could be, but I’m sure most of you have guessed that the industry described here is the US K-12 public education industry.

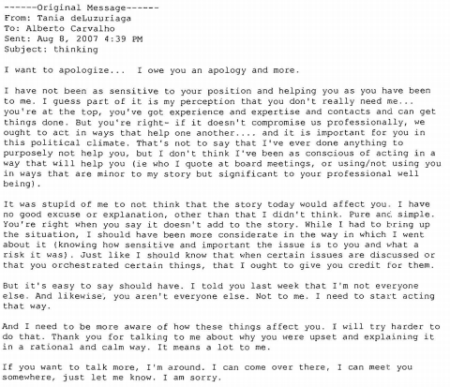

And who is it that is requesting the bailout on behalf of K-12 public education? None other than Alberto Carvalho, the superintendent of Miami-Dade schools. This is the same Alberto Carvalho who manipulated a romantic relationship with a Miami Herald reporter to advance his career. I guess when he’s not busy with naughty text messaging, he’s making the case for an education bailout: ”The question in my mind is this: At a time when we’re continuing the bailout of key industries, at what point do we have a bailout of public education?”

Watching folks scramble for bailout funds is like watching pigs at the trough. It’s only a matter of time until Starbucks gets in line. After all, the US economy needs liquidity.

(edited to note that it is K-12 public education)

Posted by Jay P. Greene

Posted by Jay P. Greene